Many governments, state councils and local authorities talk about the potential of smart cities and how they unlock new possibilities in a hyper-connected urban environment. Ideas such as the sky being filled with flying taxis, robots sweeping the streets and rooftop farming on every building may seem like the epitome of human civilisation. But, is this the future we seek? The various studies into smart city concepts all lead us to one key observation, intelligence technologies will play a far more significant role in our daily routine as compared to massively disruptive ideas.

A brief look at the global smart city landscape reveals good progress in making our cities intelligent. Examples of the international efforts to build the foundations of next-gen digital playgrounds include prominent cities:

Malaysia is rising up to its global peers on this front. The national policies under the Malaysia Smart City Framework (MSCF), which includes MyDigital, IR4RD, JENDELA and GTMP, is set to enable the translation of blueprints into meaningful action plans.

From a survey held during the previous City Leap Summit 2020, TM One collected insightful grassroots data from 33 local councils or Pihak Berkuasa Tempatan (PBTs) on smart city implementations. Results displayed that most respondents were not ready to turn plans into actions due to gaps in infrastructure, shortage of financial resources, and below-average talent capabilities.

In addition, PBTs in Malaysia focused their efforts on basic systemic issues surrounding security, safety and transportation that have already been experimented on in other countries. Out of all the solutions introduced to local leaders, smart security & surveillance, smart traffic lights and smart parking systems were the top 3 priorities to help citizens achieve a better quality of life.

While the results may reflect the state of mind two years ago, we need to think bigger. A powerful catalyst for PBTs is to reimagine how their cities can create better living experience for Malaysians. While the extensive list of smart indicators provided by ISO 37122 may appear intimidating, the journey toward building smart cities begins with a single step forward.

Many around the world have already mastered of the art of building smart cities. So, as we celebrate the remarkable technological developments in major cities worldwide, we should also learn from them. Here are a few examples of cities that have embodied the critical success factors that contribute to a winning smart city:

TM One is in a prime position to support the government’s vision for smart and sustainable cities around the nation. While fancy solutions may capture headlines, we understand the importance of a strong foundation.

We provide an unparalleled level of robust and secured digital connectivity, coupled with a solid digital infrastructure. This includes Hyperscaled intelligent cloud solution and data centre infrastructure and services that protect data sovereignty.

As TM One continues to build solutions for the needs of tomorrow, we offer a wide array of smart city solutions to address the immediate PBT needs of today. Smart city applications, dashboards, smart street and traffic lights, smart parking systems and deep surveillance are great examples of our market-ready solutions to bring our customers closer to smart and sustainable cities. In fact, 25 PBTs around Malaysia have already deployed our smart surveillance systems to keep our citizens and utility infrastructure safe.

The icing on the cake is our integrated operation centre (IOC) which is a robust platform designed to efficiently consolidate various data types from networks and Internet-of-Things (IoT) devices to intelligent applications. This integrated monitoring system will enable local governments to make quick decisions and changes in response to real-time conditions.

TM One is the one-stop hub to support Malaysia’s smart city needs

While our solutions are ready to help PBTs in their mission to roll out smart city projects, we encourage a more structured approach.

The first step is to design a smart city blueprint that narrows down the PBTs’ concerns. We no longer need country-level frameworks; we need immediate action plans. Start by finding local priorities and focus on the key problems that would best benefit the citizens when addressed.

Next, implement solutions that have quick wins and solve the core issue. Take the initiative to experiment with niche smart city solutions and validate their benefits.

Last but not least, be open to exploring different types of collaboration models. Often, private-public partnerships are good ways to leverage the unique strengths of two distinct organizations to create a powerful solution. TM One is committed to helping Malaysia move toward smart and sustainable cities for a better future.

Md Farabi Yusoff, Head of Smart City from PLANMalaysia delivered his presentation at TM One’s City Leap Summit 2002. This article summarizes the key takeaways from his address.

“Smartness” is not a measure of how advanced or complex the technology being adopted is, but how well the solutions solve the society’s problems and address existential challenges”

– YB Datuk Seri Reezal Merican bin Naina Merican, Minister of Housing & Local Government

Smart City has been a hot topic of discussion for the past decade. With the advent of IR 4.0, the technology underpinning smart cities has matured significantly. Over the years, the Pihak Berkuasa Tempatan (PBT)’s understanding of the potential benefits to be reaped through the implementation of smart cities has also evolved. The next big challenge is in making the implementation of smart cities successful. There are two key imperatives in making this possible, viz., (a) developing a holistic smart city plan and (b) a blueprint for turning fundamental concepts into action.

Smart cities cannot be developed in silos – it requires a network of connected solutions that are effectively integrated, with data feeding into each element to ensure all facets of city-dwelling are elevated to the same level of capability and efficiency. An effective smart city is both holistic in nature and all-encompassing. The network of connected solutions also needs to be functional, providing tangible solutions to actual issues faced by citizens.

Even at a conceptual level, holisticness and people-centricity need to be embedded into smart city development to guide decision-making and ensure the solutions chosen are people-oriented and realistic. For this to happen, smart cities require careful planning and development, with each decision accounting for infrastructure, city operations and digital capabilities to create the solutions capable of elevating all elements of city-dwelling.

PBTs should prioritise taking this holistic approach into the conceptual framework of smart cities:

While a holistic, all-encompassing conceptual framework underpins smart cities’ strategic development, implementing the said framework presents an entirely different challenge. Concrete action plans based on a flexible, adaptable blueprint is the surest way forward in making smart city initiatives a success.

In creating an adaptable blueprint, PBTs need to ensure that all the 4 fundamentals of smart city planning are covered. While the overall action plan can be carried out incrementally through stages, each stage needs rigorous review. Subsequent actions need to be adapted to fit needs of citizens and PBTs accordingly as new findings arise across the journey. The blueprint can broadly be classified into three distinct phases.

As the Federal Department of town and country planning for Peninsular Malaysia, PLANMalaysia’s role in the smart city agenda is to guide and support local councils in realising their smart city aspirations. Our work encompasses the four areas which are detailed below.

Creating Smart City blueprints: Effective smart city planning and implementation cannot be one-off decisions. Each element needs to feed into one another to create a network of systems and solutions. With that, PBTs need a blueprint that strikes a balance in being both definitive and flexible, and to assist decision-making when it comes to choosing solutions and deciding ways forward – this is where PLANMalaysia comes in, to guide PBTs on blueprint formation and ensure decisions made are holistic and adaptable to future needs.

Running Malaysia Urban Observatory (MUO): Data collection and interpretation are integral to smart cities. MUO is a data-sharing platform that enables public data sharing and supports decision-making. PLANMalaysia’s custody of MUO ensures that all local councils can benefit from the federal department’s collaboration and support, effectively interpreting public data in enhancing services tied to smart city systems.

SmartCity Accreditations: Involved in the makings of the standards or benchmarks for smart cities and data integration. To ensure usability of data and effectiveness of smart city implementation, certain criteria needs to be met to ensure systems chosen are in fact beneficial, functional and can be used to generate the right insights to enhance public services.

Increasing Awareness: One of the vital challenges to smart city implementation is stakeholder management, and there are many. PLANMalaysia endeavours to manage vital stakeholders by running several campaigns and programs to align all relevant stakeholders, from investors to local authorities to local communities. This fuels understanding of the ultimate goal of transforming into a smart city and the benefits that stand to be gained by all stakeholders.

When addressing smart cities in the past, we may have been uncertain of what was needed. We may have not fully grasped the technology or were not aware of what we wanted out of it. Today, we are in a much more secure position – enriched by knowledge, alongside the maturation of the technology, we are more ready than ever to be elevated towards a smarter future. The road ahead may not be simple or straightforward, but we are equipped with guides, blueprints and action plans which are both symbols and roadmaps to success. They represent our common goals is our binding objective in uniting all stakeholders towards a smarter, healthier, more sustainable Malaysia.

Smart cities made its debut as an idea over a decade ago. The growing pains of urbanisation required governments around the world to consider leveraging technology to help alleviate the big challenges facing the cities. The problems for dense cities are many, ranging from high energy consumption, traffic congestion, pollution and increase in crime. The technology is ready and available, yet majority of the smart city projects have met with limited success. As with all new things, there are risks involved. But moving forward takes a bit of courage, and a leap of faith. After all, this is what defines a pioneer; bungee jumping into uncharted territory, outside their comfort zone.

The biggest challenge by far is the complexity of the initiative and managing the collaboration between the multitude of stakeholders needed to make smart city initiatives a success.

There are three crucial building blocks to overcoming the main challenges of smart city implementation:

Let’s start with technology which is what a smart city is all about. Technology plays a crucial role in the transformation of smart cities, with benefits that stand to be gained by all stakeholders. The role of technology can be dissected into seven key aspects:

Smart city development cannot be done in an ad-hoc fashion. The various elements need to come together to form a uniform vision and serve a core purpose – to solve specific problems of the city’s residents and improve quality of life. The development of a smart city vision should embrace the following four principles:

A smart city should aim to embrace technology across all aspects of the citizens lifestyle and tight integration of a range of services from transportation, health, education, etc built around citizen journeys.

The citizens are the heart-beat of every city. A successful initiative involves building trust between the citizens and the governing body through citizen-centric decision and policy making as well as transparency of data and information. Providing citizens smart tools helps with the data collection effort. This helps mitigate the “black hole” problem, with information on any pressing issues reported by concerned citizens made readily available for authorities to address them at the earliest.

Through widespread data collection, smart cities can solve many problems quickly, made possible by insights from data. An iterative approach that enables constant problem solving is crucial for long-term success. Data insights can also help city managers and planners address the core issues that impact every citizen and minimize chances of recurrence.

Another concept that smart cities should internalise is the DNA of a smart city, namely, Devices, Networks, and Applications. A successful smart city harmonises the interaction between its devices used in daily operations, connected by a network that sustains it, and managed through the use of applications and software’s to ensure a seamless operation and function void of errors.

A successful smart city implementation cannot be achieved without the proper governance and management, support from stakeholders buying into the idea, and the feedback from the citizens living within. Vision and ideas are relatively simpler to define, the challenge is the execution. The key success factors include:

While the task seems daunting, there are many global best practices we can follow. The technology has matured and the right funding models are coming into place. We need to act with a sense of urgency. As we embrace the new post-pandemic future, the time to act is now. Failing which we will have only compounded the many challenges for our already fast-growing cities.

Learn more on how Smart City contributes to our nation’s aspiration in becoming a Digital Malaysia.

“Kerana kemudahan tidak hanya untuk sebahagian kelompok, tetapi untuk semua”

"Because convenience is not for a few, but the masses"

Setiaji, Chief of Digital Transformation Office at Ministry of Health / Assistant of Minister for Health Technology, Indonesia

Half of the world's population are city dwellers, and with the breakneck speed of technological advancement, a government that fuels digital technologies stands to endure significant long-term economic benefits. Cities that are slow to embrace the digital race risk falling further behind the pack.

With an average density of 1,400 population per square kilometer, West Java is home to 50 million people across 27 regencies and 620 districts. While it is the most populous province in Indonesia, its human development index is lower than Indonesia's national average. Wide socioeconomical and digital gaps are spread within its 1,576 urban villages and 4,301 rural villages.

Pemerintah Jawa Barat or the West Java Provincial Government understands that to inch closer to the smart city pole position, its version of smart city needs to be inclusive of the rural areas. Faced with complex government bureaucracy, compounded with a lack of innovation in the government service, West Java Provincial Government initiated an in-house digital team — Jawa Barat Digital Service or Jabar Digital Service. Early in our journey, we saw that to build a smart city tailored to the West Java ecosystem, we needed to bring together best-in-class tech talent and institutional stability in one team. Jabar Digital Service, in essence, is a start-up under government purview with a massive scale to impact.

There are three anchor drivers that propelled West Java into becoming one of the region’s fastest smart city adopters: People. Process. Technology.

For a city to become a leading smart city, the importance of talent is second to none. However, according to the World Bank, Indonesia will have a 9-million digital talent shortage by 2030 if initiatives are not taken to address this in the interim.

To fill this potential gap, Jabar Digital Service launched its inaugural Candradimuka Jabar Coding Camp in 2021. This first batch of full-fledged coding camps received 11,730 applicants, with 844 being successful in their applications. Additionally, and more impressively, 18.9% of the 844 successful applicants are among the underprivileged, disabled or high school leavers. All graduates of the coding camp are now either absorbed in Jabar Digital Service, assimilated into the Indonesian technology industry, or opted to become freelancers taking advantage of the budding gig economy. As a result, we now have more than 300 new additions to the digital workforce consisting of mainly young, exuberant talents mentored by senior government officials and private sector experts.

An advocate of the 'Right First, Fast Later' mantra, Jabar Digital service believes a deep and resilient process is the cornerstone of any smart city. There was a perception that regulations were a barrier to innovation. Hence, the first point to address was to fine-tune existing regulatory policies to foster regulator engagement in the innovation process.

At a broader level, to invigorate a culture of innovation at various levels and among diverse stakeholders, we took a 360° view and synergised the business process with governance and infrastructure to support this interactive innovation. All this, of course, needed to align with our budget and stretch every Rupiah.

Smart cities may have become one of the main agendas for governments worldwide, but there is still a substantially unmet need for the largely overlooked and underserved population.

As West Java comprises of primarily rural locations and with our citizens only being able to afford basic technical equipment, our smart city technology of choice needs to be brought down to the lowest common denominator to make it inclusive for everyone and reduce the digital divide.

At Jabar Digital Service, we believe the launching of a digital blueprint is not enough. The execution must be accessible for all stakeholders to be able to develop at a furious pace.

Here are some examples of our flagship products that have impacted the West Java society significantly.

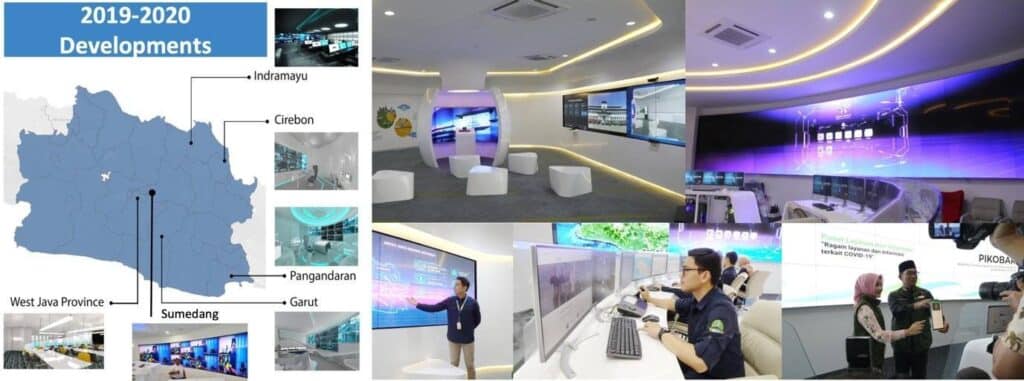

The Jabar Command Centre is a data visualisation and monitoring centre which centralizes and integrates data from all operations and public services available to citizens of West Java.

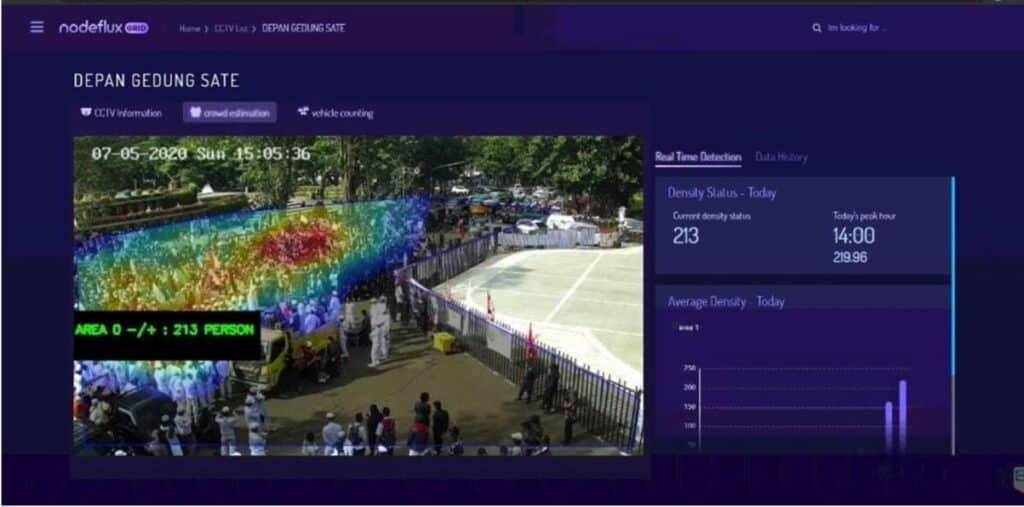

Public Gathering Monitoring, Smart CCTV surveillance that feeds the command centre with information of an estimated number of mass gatherings, average density and peak hours. The collection, monitoring and analysis of information allows the government to monitor public protocols and coordinate for security measures whenever necessary.

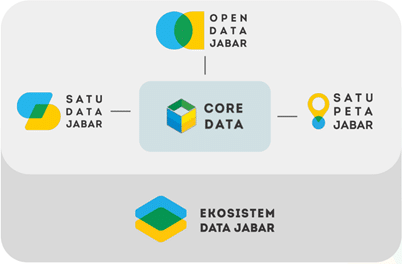

Ekosistem Data Jabar (EDJ), EDJ is a data ecosystem which integrates data from four main sources (OpenData, SatuData, Satu Peta & Core Data). Information gathered from this integrated ecosystem generates ‘smart’ insights which, in turn, supports data-driven decision making. The use of public and open data has also heightened transparent leadership while encouraging public participation in the urban development of West Java.

Sapawarga, the West Java government’s Superapp was launched in 2019 with 3 main purposes:

Pikobar, A day after West Java declared a state of emergency due to the COVID19 pandemic, JDS launched the Pikobar website. The Pikobar app was released 16 days later. Since the launches, Pikobar has been releasing real-time data and enabling integrated COVID-19 related services via both app and website. The services include 32 features such as teleconsultation / telemedicine, multivitamin prescription, delivery and administration of oxygen and more.

The overall objective of the Digital Villages Theme is to overcome the digital divide in rural areas, by covering 3 major pillars:

There is one key trait driving the success of West Java’s smart city transformation: unity. From governments and local officials having a clear and aligned vision of a smart West Java, to an inclusive action plan that aims to elevate the lifestyles of all members of West Java’s society; the province is an undisputable example of the value of unity and cooperation of all stakeholders in making smart city transformation a success.

Our first City LEAP Summit in 2020 addressed the needs and challenges faced by local councils (Pihak Berkuasa Tempatan, PBT) in implementing smart cities. At the time, there were many. However, living through an unprecedented pandemic in the following two years resulted in the introduction and 180-degree evolution of these challenges.

In this year’s City LEAP Summit, we readdress the PBT challenges and reorient our efforts. Our renewed vision and clearer pathways helps us forge forward to make the smart city aspirations a reality with every PBT and its people.

In line with the Ministry of Housing and Local Government (KPKT)’s initiative in creating a “Liveable Malaysia”, TM One is committed to pioneering and co-creating digital transformation for the cities of the future. Championing a Liveable Malaysia through the creation of smart cities is very much aligned with our goal of becoming a human-centred technology company and our belief in “Life Made Easier”.

The advent of smart cities will help create a higher quality of life for citizens by using technology to support local business communities, thereby increasing the efficiency of public services and creating a more sustainable, friendlier environment.

The implementation of an effective smart city transformation is easier said than done. Challenges await each PBT with many moving parts and considerations to be made. However, in our endeavours and experience in cooperating with several PBTs, we have identified four key elements for success:

To date, we have made several initiatives with PBTs:

We are forging ahead, co-creating with PBTs on various digital services for the seamless use and benefit of the people and businesses. TM One remains a committed strategic partner to all PBTs in realising their aspirations toward becoming smart cities. Our objectives are clear – to implement the best-in-place integrated solutions that cater to each city and champion human-centred technology in accomplishing a “Liveable Malaysia”. TM One is the trusted partner who enable PBTs’ next advantage, today and tomorrow.

With technology advancing at its rapid pace, digital transformation has become a priority for many organisations, regardless of industry. Digital transformation is the process of using digital technologies to revolutionise existing, as well as non-digital business processes and services to create new ones in order to meet the market’s evolving needs.

Many businesses seek digital transformation for a number of reasons. Among them, having access to more in-depth data may equate to understanding customer insights better and, thus, having the ability to create a strategy that connects with them better. On top of that, there is also room for cost reduction as a result of time savings in operational processes.

Strategic partnerships may also be a strategy to employ when undergoing a digital transformation, as it allows different businesses to leverage and learn from each other in order to better meet any challenges the future may hold.

In March, Tune Protect, Huawei Malaysia, and TM announced an exciting new collaboration to re-platform Tune Protect’s existing General Insurance System (GIS) on Cloud via Huawei Malaysia and TM’s Cloud infrastructure, Cloud Alpha Edge. This significant shift signifies that Tune Protect is the first insurer in Malaysia to host its core insurance system on Cloud.

As part of the Cloud First strategy, the core system includes a collection of SAP HANA and SAP apps that will be comprehensively housed in TM Cloud Alpha Edge with full landing dependability and confidence.

According to Muhammad Ghadaffi Bin Mohd Tairobi, TM One’s Vertical Director of Banking & Finance Sales, “TM One is committed in accelerating the digital transformation journey of our customers by helping them to provide the best digital experience to their end-users. This is particularly true in these times where digital transactions have increased exponentially. Tune Protect’s success in adopting Core System in Cloud Alpha Edge is a benchmark for all companies in the Banking, Finance and Insurance industry to embark on the public cloud journey confidently. Not limited to just cloud adoption, we provide end-to-end digital solutions for innovative product development while providing the best solutions and infrastructure such as cybersecurity and big data analytics enabling omni-channel, data monetisation agenda, leading to cost optimisation.”

Tune Protect, on the other hand, always had Cloud as the centrepiece of the digital transformation. Prasanta Roy, Group Chief Technology Officer of Tune Protectshares that having the SAP insurance core platform on Cloud helps to fast track innovation in their products and services, achieve speed-to-market, and provide differentiation in service to their customers. “Being the first insurer is a mere coincidence, but it has definitely the right step to set up the right foundation for technology transformation,” he adds

Besides being a product of two large scale companies, Cloud Alpha Edge has an array of unique distinctions to its name. To date, it is the only Malaysian-owned Hyperscaler Public Cloud that actively advocates data sovereignty.

To date, Cloud Alpha Edge is the only Malaysian-owned Hyperscaler Public Cloud that actively advocates data sovereignty.

TM One is also the only local player with its own twin-core data centre, cloud infrastructure, with complete data residency and sovereignty. This infrastructure is strengthened through AI, and advanced cybersecurity solutions. This is especially suited for industries that are at high risk for cyber threats such as Public Sector and Healthcare. In fact, Cloud Alpha Edge already has multiple footprints in these industries, as well as Manufacturing.

With the rise of Insurtechs across the globe, it is quite evident that insurers will partner with various players in this space to bring in differentiation. Taking a closer look at data privacy, data residency and PDPA has to be taken into account. Tune Protect’s risk, governance/compliance and technology team worked together on all these aspects carefully while considering various public and private cloud options available within and outside of Malaysia. Cloud Alpha Edge came closest to meeting this need as the cloud data centres are based in Malaysia and customers are assured that their data remain preserved with the highest data sovereignty and confidentiality, as shared by Prasanta.

This also implies that data on the Cloud is stored in Malaysia rather than overseas, addressing the issue of data sovereignty. “They (Huawei Malaysia and TM One) are the right partner for Tune Protect based on all the considerations such as availability zones, SAP partnership with TM, and support availability around SAP from Cloud service provider,” explained Prasanta.

The working together between Tune Protect, Huawei Cloud, and TM One seek to improve a number of things. For one, Tune looks to support improvements in the area of speed-to-market, leveraging the agility and scalability of cloud services whilst also accommodating to the spike and decline of the market. In addition to that, enhanced customer experiences are also something they look forward to through improved IT productivity and a seamless user experience.

“As technology progresses and customers demand more personalisation, it is the right time for us to build the new SAP core system on Cloud to collaborate with other ecosystem partners to deliver a personalised experience for our customers in terms of product and claims,” continues Prasanta.

Not only will this partnership benefit existing and future users of Tune Protect, but the re-platforming also benefits company employees. With the presence of Cloud services like “racking and stacking” which can be completed by the Huawei or TM One team, this would free up the time of their internal technology team.

It’s only realistic for this transition to face its own set of unique challenges, such as converting the legacy on-premises software to Cloud-native. In preparation for any transitional friction the team may face, Tune Protect has lined up a mitigation plan that includes various Cloud certifications, online training, and on-the-job training for the respective team members to ensure a smooth and seamless process.

Prasanta also shared that the Infrastructure and Security teams will be upskilled so they are able to manage hybrid data centres, consisting of both on-premise and Cloud.

Migrating the critical systems to Cloud where on-premise hardware is nearing expiry would be next for Tune Protect, he adds. Consumers can look forward to new services such as health tech and other innovative solutions from Cloud that would enhance customer-centricity and experience as they aspire to grow more digital partnerships in the near future, in alignment with the overall Group’s business trajectory.

Huawei Malaysia believes that this collaboration is a strategic move that encourages data sovereignty in Malaysia, especially as no other public cloud service providers currently offer this, as mentioned by Lim Chee Siong, Vice President of the Cloud Business Unit at Huawei Malaysia. It marks a major breakthrough in FSI digitisation in Malaysia and Huawei Cloud also hopes they are able to help accelerate digital transformation in banks and insurance companies across the country.