In Malaysia, banks are stepping up in their journey into more sustainable financing and operating practices, making efforts to integrate environmental, social and corporate governance (ESG) considerations into their governance, business strategy, operations and risks management.

Consulting firm PwC conducted a survey last year to gauge the Malaysian banking sector’s readiness for ESG. Results from the study were released recently and showed that financial institutions in the country have woken up to the ESG imperative, with most sharing concerns about climate change, environmental and social risks.

Of the 14 Malaysian banks polled, 90% indicated having assigned a department to operationalize ESG, showcasing that Malaysian banks are making progress in establishing governance and oversight over ESG risks.

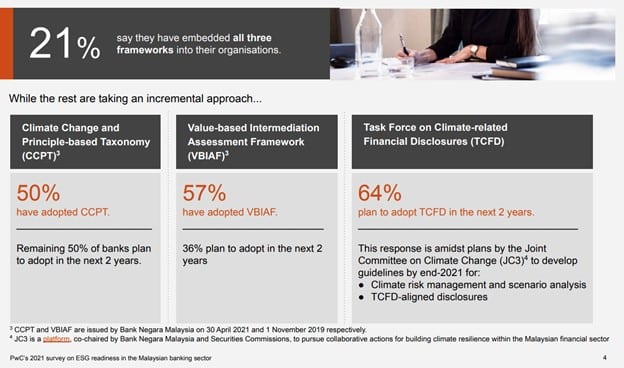

In addition, 21% of respondents said they have already embedded three ESG-related frameworks within their organization, namely the Climate Change and Principle-based Taxonomy (CCPT), the Value-based Intermediation Financing and Investment Impact Assessment Framework (VBIAF), and the Task Force on Climate-related Financial Disclosures (TCFD).

Results from the 2021 PwC survey echo those of a study conducted the same year by Malaysia’s Joint Committee on Climate Change (JC3). Formed in 2019, JC3 is a committee co-chaired by representatives from the Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC) that focuses on building climate resilience within the Malaysia financial sector.

The study, released in April 2022, shares findings from a survey of 24 respondents in the banking, finance and insurance sectors, and found strong commitments from Malaysian financial institutions on sustainability and climate issues.

92% of respondents indicated having a sustainability strategy in place, and 73% of banking respondents said they have made some commitments to ban or phase out financing of coal-related activities.

In the banking sector, Hong Leong Bank has been praised for being among the industry’s leaders in ESG standards, recognized by a 2021 CGS-CIMB Research paper for its efforts in promoting ESG practices across its operations, working with its borrowers to improve standards, incorporating ESG evaluation in its loan approval process, and practicing disclosure of ESG-related information.

Within the telecommunications sector, CGS-CIMB Securities has ranked Telekom Malaysia (TM) highly from an ESG perspective, highlighting the telco’s ability to consistently meet the regulator’s quality of service (QoS), key performance indicators (KPIs), relatively lower regulatory risks compared to other mobile telco players, and continuous effort to implement a robust cybersecurity framework.

TM announced earlier this year that it had implemented the use of renewable energy to power its data centres, becoming the first company in the country to do so. Two of its data centres, namely the Klang Valley Core Data Centre (KVDC) in Cyberjaya and Iskandar Puteri Core Data Centre (IPDC) in Johor Bahru have secured the Green Electricity Tariff (GET) from Tenaga Nasional Berhad (TNB), as well as Green Building Index (GBI) and Leadership in Energy and Environmental Design (LEED) certifications.

Further showcasing its commitment to sustainability, TM, together with Yayasan Sukarelawan Siswa (YSS) and 18 partners comprising local councils, institutions and universities, recently collaborated to plant 5,017 Gutta Percha trees (instrumental in the early beginnings of the global submarine telegraph network) at 23 locations all over Malaysia.

Members of the public will also have the opportunity to contribute as TM launched its Adopt-A-Tree campaign where customers can adopt a Gutta Percha tree which will be planted within the 23 unifi Green Zones.

In the long term, TM aims to cut down carbon emissions by 30% in 2024, 45% by 2030 and achieve Net-Zero emission by 2050.

The company is also aiming to provide high-access Internet to at least 70% of premises nationwide and has committed to having a minimum of 30% representation of women on its board of directors and in management.

Progress observed among Malaysian firms in integrating ESG considerations comes on the back of an ongoing push by the government to advance sustainability, as well as strengthen security, wellbeing, and inclusivity.

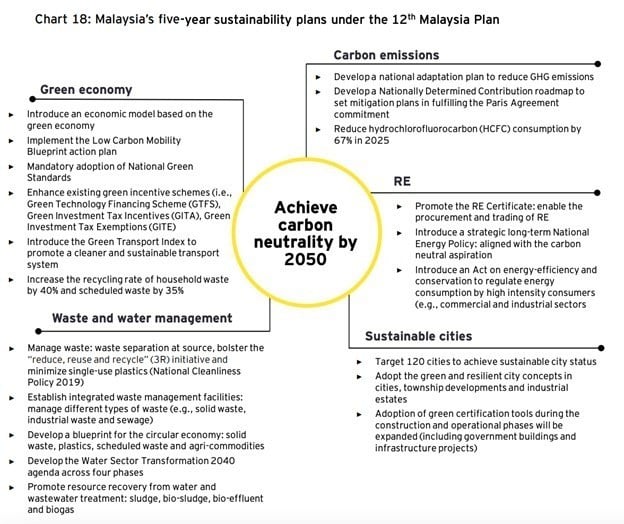

The five-year 12th Malaysia Plan (12MP) development plan, introduced by the government back in September 2021, aims to achieve economic growth and transform Malaysia into “a prosperous, inclusive and sustainable country.”

Goals include achieving carbon neutrality by 2050, increasing the total installed capacity of renewable energy, enhancing green financing and incentives, and promoting the circular economy.

In the financial sector, the industry is guided by the respective blueprints and masterplans released by the regulators to address sustainability and climate issues.

In September 2021, the SC launched the Capital Market Masterplan 3 (CMP3), which serves as a strategic framework for the capital market to continue to support the economy and transition towards greater inclusivity and sustainability.

And earlier this year, BNM released the Financial Sector Blueprint 2022-2026, outlining the central bank’s development priorities for the financial sector over the next five years, anchored on efforts to foster market dynamism, support sustainable development objectives, and facilitate an orderly transition to greener, more climate-resilient economy and financial sector.

The rise in importance of ESG standards comes as consumers are growing more concerned about the environment and demand institutions to behave in ways that align with what they believe is socially responsible.

PwC, which polled 5,005 consumers, 2,510 employees, and 1,257 business leaders in the US, Brazil, the UK, Germany and India last year, found that 83% of consumers believe companies should be actively involved in creating ESG best practices. More significantly, 76% of consumers said they would discontinue relationships with organizations that treated employees, communities, or the environment poorly.

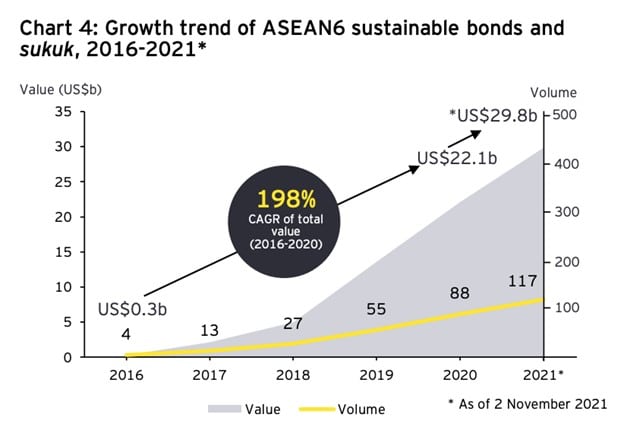

In Southeast Asia, this trend is evidenced by the surge in sustainable investing. Between 2016 and 2020, the issuance of sustainable bonds and sukuk, or bond-like instruments used in Islamic finance, grew exponentially at a compound annual growth rate (CAGR) of 198% in ASEAN, reaching US$22.1 billion in 2020, a 2022 report by EY shows. Total ASEAN sustainable bonds and sukuk issued is projected to amount to US$29.8 billion in 2021.

This article was first published by FinTech News Malaysia